Klarna chief executive officer Sebastian Siemiatkowski is reportedly prioritising hiring over AI to boost its customer service arm.

In an interview to Bloomberg, the chief executive revealed the FinTech is slowing down AI adoption to prioritise human interactions, admitting that Klarna's AI driven job cuts have "gone too far".

According to the chief executive, the FinTech is now testing a new cohort of staff “in an Uber-type of setup” that can log in and work remotely and take up customers’ requests as representatives of the bank.

The move comes after the Buy Now, Pay Later (BNPL) firm announced in 2024 plans to potentially halve its workforce with the technology as part of cost-saving measures.

Siemiatkowski also revealed that the business is planning a recruitment drive so that people using its customer services have the option of speaking to a real person rather than a chatbot.

“As cost unfortunately seems to have been a too predominant evaluation factor when organising this, what you end up having is lower quality,” Siemiatkowski said.

The chief executive also emphasised the importance of its human workforce for the company’s growth.

“Really investing in the quality of the human support is the way of the future for us,” he said.

Last August, the Swedish BNPL giant said in letter to shareholders it was planning a reduction of its workforce, flagging a move towards a more aggressive use of AI.

The FinTech, which cut its workforce from 5000 to 3800 during 2023, said it was expecting more dramatic reductions.

Klarna said that changes to its workforce were largely be attributed to natural attrition, including due to resignations, sickness, or retirement, but that AI would play a role in the next cutback.

The chief exec added at the time that the company’s AI assistant had a powerful role for its customer service arm, helping to further improve its shopping experience.

According to Klarna’s 2024 financial statement, the FinTech registered revenue growth of 27 per cent in the first half of the year.

Adjusted profits reached $66 million over the six-month-period, a sharp rise compared to adjusted loss of $45 million in the previous year. Siemiatkoski identified AI as a key driver of Klarna’s stronger results.

"Our AI assistant now performs the work of 700 employees, reducing the average resolution time from 11 minutes to just two, while maintaining the same customer satisfaction scores as human agents,” he said at the time.

Klarna currently serves 93 million active consumers and over 675,000 merchants, with the firm announcing this month it has reached over 11 million active customers in the UK.

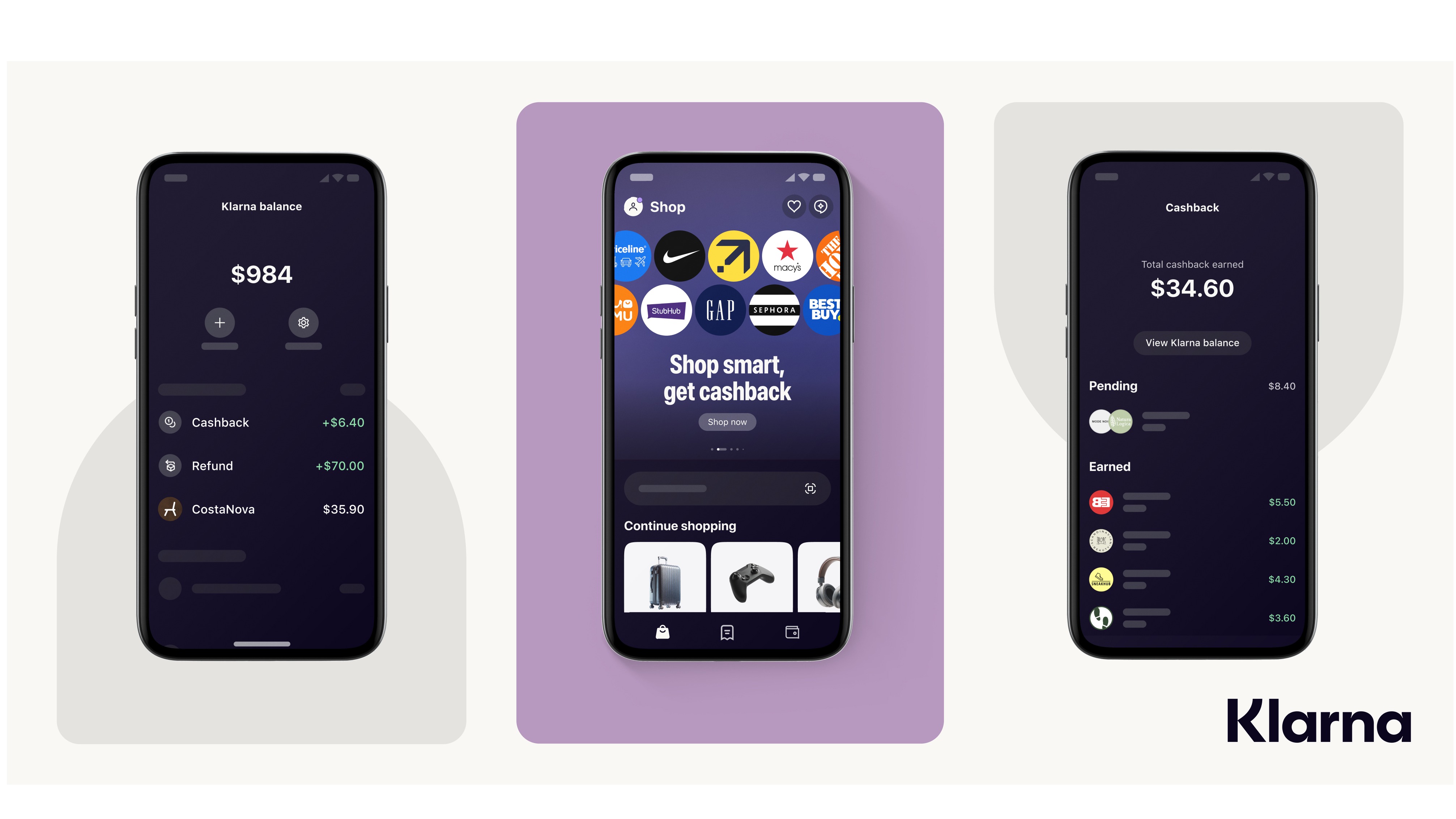

The company offers a range of services including flexible payments, delivery tracking and spending insights.

Last month, the FinTech signed an agreement with point-of-sale provider Clover to bring its services to businesses and shops in the US.

The partnership will initially enable around 100,000 merchants to offer flexible payment options for in-store purchases.

Latest News

-

Indra wins TfL contract to run London ticketing systems

-

Japan ‘launches government probe’ into Grok

-

Social media sites stop access to 4.7m under-16 accounts in Australia

-

Government announces £52m funding to support British robotics and defence tech firms

-

Swift to launch blockchain-based shared ledger after successful digital asset pilot

-

AWS launches European sovereign cloud service

The future-ready CFO: Driving strategic growth and innovation

This National Technology News webinar sponsored by Sage will explore how CFOs can leverage their unique blend of financial acumen, technological savvy, and strategic mindset to foster cross-functional collaboration and shape overall company direction. Attendees will gain insights into breaking down operational silos, aligning goals across departments like IT, operations, HR, and marketing, and utilising technology to enable real-time data sharing and visibility.

The corporate roadmap to payment excellence: Keeping pace with emerging trends to maximise growth opportunities

In today's rapidly evolving finance and accounting landscape, one of the biggest challenges organisations face is attracting and retaining top talent. As automation and AI revolutionise the profession, finance teams require new skillsets centred on analysis, collaboration, and strategic thinking to drive sustainable competitive advantage.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories